Defining “Agency”

I think the term Agent has lost some of its importance over the years. Since some insurance companies have massive advertising budgets, then use the term Agency for their sales team. It is no surprise that the average person then associates “Agency” with the business that sells a product for an insurance company.

This term is so ingrained with our understanding of insurance that it is very common for people to associate agents with one particular insurance company. We see this all the time with captive agents, for example, The Smith Agency, or the Johns Agency.

Dusting off the dictionary

Looking through several different sources, agency would mean that the individual can act independently. In many cases, this independence is limited via one’s morals or social norms. Children may have control of their actions, but they do not have agency until they can understand the gravity of their actions. Our society limits their agency to act until 18 or 21.

In the insurance world, it is a business or organization that organizes the transaction between two parties, typically the client and said insurance company. This means that all agents broker the sale between the client and the insurance company, even captives. They present the client and the underwriting information and broker the deal between the insured and insurance company. Captive agents just decide to broke these clients with a single company.

The short answer is: Insurance Agents act on behalf of their clients.

When it comes to purchasing insurance, the client can exercise their agency and purchase directly through some insurance carriers. The vast majority of people are not experts in insurance contracts, and understand what they do not know might cost them in the future. So when selecting an agent…

The million-dollar question is, who are they an agent for?

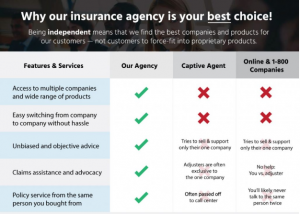

Captive insurance agents (Allstate, State Farm, Farmers, Amica are a few off the top of my head) have a fiduciary responsibility to their those companies. They have no fiduciary duty for their clientele, nor do they have a choice on who they can broker with. They have to meet sales goals and operate under the demands of that insurance company. So when you are working with an agent who has only one insurance company they can offer, understand that the advice provided is not meant to provide agency for their clients, but an agency for the insurance company.

Who is doing who the favor?

As a former captive insurance agent, I saw this happen all the time. Clients would call in upset about the increase in premiums, and the service team would “lower” the premium by removing thousands of dollars in coverage. So the insurance company now has to pay 200,000 less for this client at a savings of 20 dollars/month. Great deal, huh?

Insert Independent agents

While independent agents hold the same license as captive agents, the business models are vastly different. Having a choice of carriers changes the role of sales to an agent. When I worked for a captive agency, I was limited in what kind of clients we could help, and if the price was too high, the only recourse I had was to cut coverages. As an independent agent, once we build a profile (Agency), we can offer these clients to a number of insurance carriers. I could never understand how a captive agent could assume the role of a trusted advisor but only advise on a single option.

Now- let me be clear- captive agents are bad people, and their companies aren’t evil incarnate. The vast majority of people in the US are insured under big red. These agents are doing their best, with a fine product, for the people they serve. I am the first agent that if we come across a client with a captive company, and the coverages are correct, and the price is right, we will advise they stay.

The point of this article was merely to point out the difference between the two kinds of agents. Understand who you are working with, and their business model.

For me, and my clients, I have accepted the role of agent. Every decision revolves around Educating, Insure, and Serve our clients. We do this by educating our clients, providing a variety of choices, and servicing the needs of our clients.

If you would like to chat about your options, feel free to fill out the form below!