Rates are going up, but why?

First, know that all insurance rates are carefully monitored by the Department of Insurance (DOI) and all rate adjustments must first pass their review in order to prevent discrimination and undue rate increases.

Part of that review is an examination of the rate increase, and data used to justify that premium. Profits are capped, so insurance companies provide loss ratios, and cost of doing business reports to help justify rate changes.

Contrary to popular belief, insurance rates go down for many of our clients if new data shows a lower loss ratio for a demographic, or zip code.

Yet more often than not, you should expect your rates to go up about 5-8% annually.

Why? This is to keep up with inflation or the cost of doing business. A larger increase can suggest changes in the insurance or inefficiencies, or increased loss ratios within that insurance company.

Cutting to the chase, every single insurance company is aggressively increasing premiums.

Like most things, a combination of the pandemic, supply chain issues, an increase in the cost of doing business, and INFLATION, are some of the root causes for these rate increases. Anyone trying to buy a home, trying to get work done to a home, or purchasing a vehicle understands that the cost of all these things has risen significantly, so the same is true for all insurance companies.

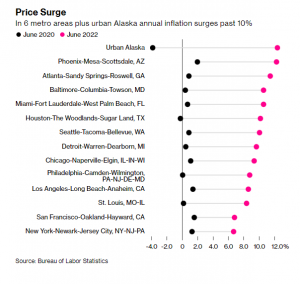

According to Bloomberg.com-

Inflation went from .09% to 11% for the Atlanta/Sandy Springs-Roswell area.

The consumer price index has shown steady and higher than average inflation numbers for the home and auto industry as well.

Claims cost

Everything from fender benders to total loss costs has skyrocketed as well.

- Delay in parts leads to the increased rental cost

- The price of parts has increased due to shipping delays/shortages

- There is a demand for higher labor wages in the blue-collar workforce.

Total loss settlements are also on the rise and then the increased cost of both used and new cars prices, the entire industry has to adjust.

According to Consumer reports.org- prices from 2021 to 2022 have increased used car prices up to 22%

Don’t be so fast to hate insurance companies though

Everyone is asking for a lower rate. People shop based on their rate, and insurance companies know this. In an effort to remain price competitive these companies have to run skinny. That can mean a reduction in claims, or customer service, all the way to lower coverage options/limits.

What’s the solution?

It might be obvious, but partnering with an independent broker with options wouldn’t hurt. We did the hard work of partnering with insurance companies and smoothing our technology to better leverage our time and accuracy of quotes, all that is left is partnering with you!

If you have seen a 15% increase or more, it’s time to shop, especially if you have been with the same insurance provider for over five years!